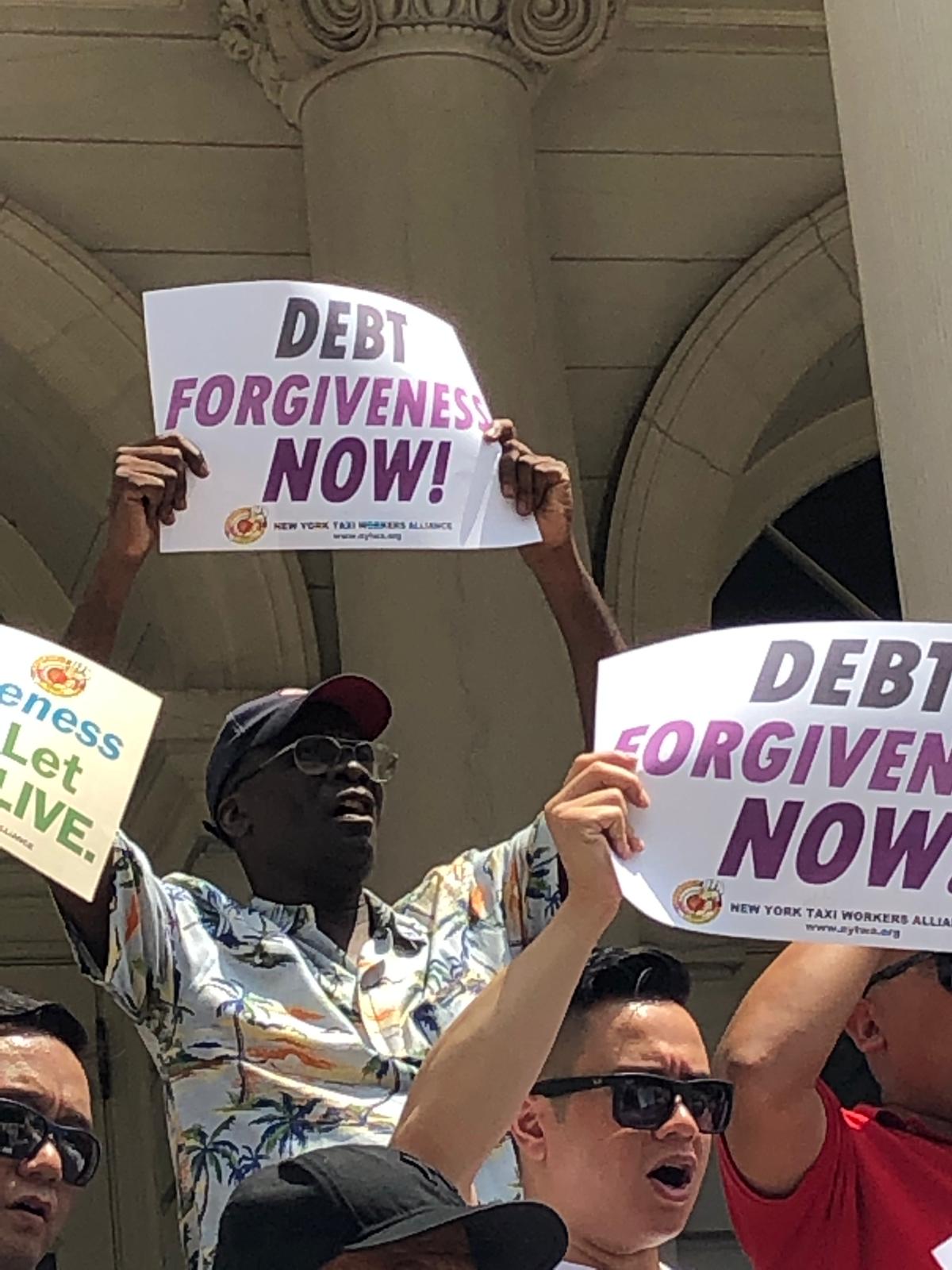

Debt Forgiveness Rally Today, Join Raise for App + All Drivers Rally Next Thursday!

With one day's notice, 75 Owner-Drivers showed our force at a press conference with Council Member Mark Levine and Council Member Carolina Rivera for debt forgiveness. UBER, LYFT, VIA, JUNO DRIVERS: It's your turn on Thursday July 18th at 2PM at City Hall as we RALLY to:

+ Protect the Vehicle Cap! (TLC Hearing is on July 23 at 12pm at 33 Beaver Street!)

+ Win a Cap on FHV Lease and Financing Rates!

+ Officially petition the TLC to set minimum passenger rates across the industry and require App companies to give drivers at least 85% of the fare!

+Win an end to unfair deactivations where drivers are fired with no reason, just cause, or appeal!

When we come together and show our power, we can win. Check out the photos from today's press conference below, and all drivers get ready to mobilize so that we can win a Raise for All!The City Council will be holding the confirmation hearing for the new TLC Chairperson, Jeff Roth, at 1pm. We are holding our rally at 2PM with the DRIVERS PLATFORM to start his tenure with our demands upfront!

ALL DRIVERS - Yellow, Green, App-based, Black, Livery - RALLY TO WIN A RAISE FOR ALL!

Next THURSDAY, JULY 18th

2:00pm

Steps of City Hall

Check out photos and updates from today's press conference!

We called on the city to provide debt forgiveness for struggling owner-drivers through our lively chants - even the Council Members joined in! Our rally and testimonies from members Mouhamadou Aliyu and Mohammed Hoque showed debt forgiveness is needed and we proved it's possible with $2 Billion, not $13 Billion as the Mayor's office has said. The National Credit Union Administration (NCUA) which took over Melrose, LOMTO and all credit unions admitted to restructuring loans, cutting interest rates and extending terms for lenders and we know banks are buying from each other at lower, marked down loan amounts. We demanded that the mark downs go to the Owner-Drivers and that the City of New York which made $850 Million from 16 auctions and set the last auction opening bid at $850,000 even though seven government agencies knew it was too high, must find a financial way to help with the debt forgiveness and a retirement fund with cashout for older drivers who are still driving. STAY TUNED for more actions! Today was City Hall, next will be the banks and NCUA!

We are going to keep all of these campaigns moving at the same speed, brothers and sisters! And united we will win them all! See you all on Thursday at 2pm at City Hall!

Photos from July 11th Press Conference with Council Members Mark Levine and Carlina Rivera

Here's how we calculated cost of debt forgiveness for taxi owner-drivers:

Medallion Industry Background

This industry background is a summary of Brian Rosenthal’s two-part investigation in The New York Times, published May 19, 2019 “They Were Conned: How Reckless Loans Devastated a Generation of Taxi Drivers” and “As Thousands of Taxi Drivers Were Trapped In Loans, Top Officials Counted the Money.”

Medallion created in 1937, sold 12,000 for $10 each. Sold again for first time in 1997 under Mayor Giuliani.

Prices were stable 1995-2002; then spiked 2002-2014; and crashed in 2014.

In 2005, 92% of drivers were immigrant, with 40% from South Asia.

The spike in medallion value started in 2004. The City advertised medallion prices on average 13 percent higher than they really were according to the NYT.

Between 2004 and 2014, the City made $850 Million from medallion sales during (16) auctions and transfer taxes collected when medallions are sold on the private market. Since 2009 to today, NYS has collected over $600 Million from a 50cents tax on all taxi trips. Medallion values were touted as indicators of a healthy industry when the tax was first introduced in 2009.

Seven government agencies knew the price was inflated but allowed the auctions and sales to go on.

Banks involved in 2008 housing crisis and under federal regulation entered the medallion lending market. Instead of lending directly, they worked with brokers and fleets who would line up buyers, loan to them and collect a cut of the monthly payment and sometimes an additional fee.

Banks made money in 2017 and 2018 when owner-drivers were struggling with payments by using practice called confession of judgment, which was banned by Congress in consumer loans but not in business loans, which is how lenders classified taxi medallion loans; it is also banned by some states even in business loans, but is allowed in business loans in NYS. Borrowers sign papers saying the lender can get paid total loan once balloon ends.

Additional fees and costs were added to make total loan higher: origination fees, legal fees, financing fees, refinancing fees, filing fees, fees for paying too late and fees for paying too early; long contract terms to lock in high interest payments; interest-only loans; interest rate spike 24% if loan not repaid in three years.

Lenders continued to promote high sales, all while they were making plans to leave the industry.

Credit unions selling medallions at high amounts were selling their loans to banks.

By 2013, down payments were not being required of buyers.

Congress passed a law in 1998 to exempt credit unions from requiring buyers to pay a down payment of at least 20%. No agency tried to change it after seeing the predatory practices. The federal government also provided many medallion lenders with financial assistance and guaranteed a portion of their loans.

TLC staff wrote a report in 2010 that value was inflated; but Bloomberg Administration and TLC ignored it.

In 2011, NCUA wrote a paper on the risks of the industry; in 2012, 2013, and 2014 they had reports of credit unions violating lending rules. NCUA never penalized or added oversight.

Since 2010, the NYS Department of Financial Services wrote warnings of inflated values and issued at least one report that the bubble would burst. In 2014, they called a meeting of dozen top officials.

During the same time period - 2010-2014 – about 1,500 people bought medallions.

Final auction in February 2014 had 150 bidders; 40% have filed for bankruptcy.

In 2017 and 2018, NCUA took over loans but never softened terms.