Recent Campaign News

July 25, 2019: NY House Dems call on city to bail out thousands of cab drivers suffering because of taxi medallion ‘crisis’, New York Daily News

July 19, 2019: New York City to Increase Regulation of Taxi Medallions, Wall Street Journal

Sign Up For a Hardship Letter

If you are an owner-driver and need assistance with a Hardship Letter to give to the bank requesting a lower monthly mortgage and debt relief, sign up for a hardship letter with the union! We will need copies of these documents in order to complete your hardship letter:

2018 Income (from Verifone or CMT)

Last loan statement

Medallion loan contract

Any doctors letters or other hardship letters

Credit Card bills

2018 tax filing

NYTWA Campaign for Owner-Driver Debt Forgiveness

Yellow cab medallion owner-drivers are drowning in debt from underwater loans and from everyday poverty as revenue keeps falling while surcharges and fees deplete incomes even more. A 10-month, ground-shifting New York Times investigation found a decade of predatory lending practices and government complicity in inflating the value – all during the years in the lead up to Uber and Lyft entering the market. The City of New York made $850 million from 16 auctions from 2004 to 2014. The City sets the “opening bid” and then borrowers compete with sealed bids, each in desperate speculation to outdo the competitor. Some of the same city officials oversaw high opening bids - $850,000 for one medallion in 2014, allowed in Uber and Lyft unregulated, and then went to work for the same Wall Street companies. Some of the same lenders that inflated the value and made money off interest and fees, are now selling loans to hedge funds at reduced rates but remain unwilling to restructure loans to the current market value for borrowers. The lives of six thousand owner-driver families are in ruin.

Our Solution

We are calling on the city to create an entity to buy the loans at the medallion's current market value of $150,000 and to restructure loans with owner-drivers at the new rate. So, for example, if an owner-driver has an outstanding loan of $600,000 and the city-private entity could buy that loan from the bank at $150,000 and then reduce the owner-driver’s debt to $200,000. The entity could make $50,000 on each such loan and earn profit off a fair market value interest rate. The monthly mortgage could be capped at $900, allowing the owner-driver a chance to survive. We are also calling on the city to set up a Retirement Fund for all drivers and provide an immediate cash out for older owner-drivers who lost their retirement when the medallion value plummeted, many returning to work in their late 60’s and even in their 70’s. Our other solutions are aimed at stabilizing the taxi industry and allowing for all drivers – owner-drivers and lease drivers – to earn a dignified livable income.

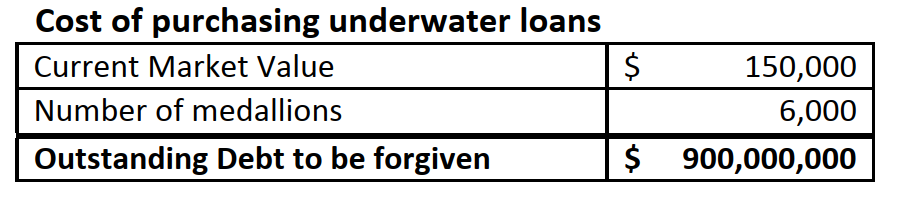

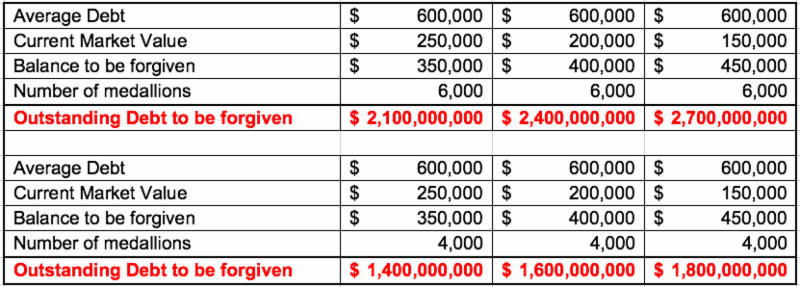

Our Calculations on the Outstanding Debt

This calculation reflects the lenders’ cost of marking down the loans, while a city-created entity could buy back the loans at the current market value of the medallion.

NYTWA’s calculation that outstanding debt is $2.7 billion, and not $13 billion as the Mayor’s office reported. Read our 7/8/19 statement on the Mayor’s report and recommendations on medallion predatory lending here.

There is wide-spread support for the city to do something meaningful to address owner-driver debt and poverty. Ten City Council Members, the City Comptroller, and a number of Congress Members have called for immediate action. The Council Speaker also assembled a Medallion Taskforce, on which NYTWA’s Executive Director serves, to investigate and make recommendations.

Campaign Background

Drivers across the industry have been in a vicious race to the bottom. Yellow cab owner-drivers are drowning in life-long debt and daily poverty wages. Taxi revenue is down 36% since 2011 to today, or 44% when adjusted for inflation. As vehicle expenses go up annually, owner-drivers have seen a pay cut as steep as 50%. Imagine earning half of what you did eight years ago. There were more medallion bankruptcies in January 2019 than all of 2015, 2016 and 2017.

Our own work on Loan Modification applications for owner-drivers, also called hardship letters, has found that their earnings are on average at a negative $25,000 for the year. That’s $25,000 worth of rent/house mortgage, gas and electricity, food, medicine, healthcare that 6,000 families in this industry are being forced to live without.

Men and women in their sixties and seventies working because the monthly payment they used to get from renting out the medallion to a taxi broker can’t pay the mortgage anymore, let alone allow for retirement. One such member of ours drove for less than a year before he had a massive heart attack. The stories of owner-driver hardships abound: heart attacks, strokes, depression, working round the clock, foreclosures, bankruptcies, evictions. Suicide. Three of the nine drivers known to have committed suicide over the past year and a half were owner-drivers. 33% representation for a segment of the workforce that is less than two percent of the driver population.

Predatory Lending

A New York Times investigation found medallion values were inflated so lenders – many of them involved in predatory loans in the 2008 housing crash – and middlemen called brokers could make extra profits off the drivers’ backs. Banks made money in 2017 and 2018 when owner-drivers were struggling with payments by using practice called confession of judgment, which was banned by Congress in consumer loans but not in business loans, which is how lenders classified taxi medallion loans; it is also banned by some states even in business loans, but is allowed in business loans in NYS. Borrowers sign papers saying the lender can get paid total loan once balloon ends.

Government Complicity

The New York Times further reported that seven government agencies knew about the scandal and did nothing. In total, New York City made $850 Million from 16 medallion auctions 2004 – 2014.

The spike in medallion value started in 2004. The City advertised medallion prices on average 13 percent higher than they really were. TLC staff wrote a report in 2010 that the value was inflated; but the Bloomberg Administration ignored it and the auctions continued. Also in 2010, the NYS Department of Financial Services wrote warnings of inflated values and issued at least one report that the bubble would burst. In 2011, NCUA wrote a paper on the risks of the industry; in 2012, 2013, and 2014 they had reports of credit unions violating lending rules. NCUA never penalized or added oversight. In 2014, the state’s DFS called a meeting of a dozen top officials. All the while, the auctions continued. In 2014, the city set the opening bid at $850,000. But it doesn’t end there. The same City, in fact some of the actual same city officials, during those same years, went from directly overseeing the auction of overvalued medallions to unleashing Wall Street-backed corporate competitors with virtually no regulations or barriers to entry and limitless cash. They then went to work for those companies.

Uneven Playing Field

Practically the only regulation in place that attempts to treat the hyper-regulated medallion yellow cab industry and Uber, Lyft, Via and Juno the same is a vehicle cap on the companies instituted after they had collectively reached 85,000 cars, compared to less than 12,000 operational yellow cabs. There are differences in vehicle retirement requirements, inspections, taxes and fees. At the airports, taxi lines outside of terminals are being erased. App-dispatched cars are allowed to drive up to terminals while street-hailing yellow cab passengers are shuttled over. After a rare joint lobbying effort by Wall Street’s companies, New York State passed a congestion surcharge where yellow cabs charge $2.50 to passengers in the zone where over 90% of their trips occur, and the App companies get to charge $0.75 as long as the passenger requests a group ride.

Between predatory loan terms, an inflated asset, and an uneven playing field, owner-drivers have been stuck in desperate poverty. Now the city must act to ensure that there is an end to predatory lending practices by requiring credit reviews, banning confessions of judgments in contracts, banning interest-only payments, and requiring attorney review of loan agreements.

The Solutions

Our approach to this crisis must be multi-pronged:

Owner-Driver Medallion Debt Forgiveness

A public-private temporary entity can buy underwater loans at reduced rates which banks are now offering to hedge funds. We estimate this cost will be no more than $900 Million.

The entity would restructure loan agreements with owner-drivers at fair market value, reflecting the new loan amount. At a current market value of $150,000, a mortgage should not be more than $900 per month, allowing owner-driver families to end the year without debt. And the public-private temporary entity would not lose money. Once stabilized, the loans can then be transferred to more permanent lenders.

The $2.7 Billion Question

Our study shows that the average outstanding debt among owner-drivers is $600,000. If the current market value of the medallion is determined to be $150,000 then the balance to be forgiven by the lenders is $450,000. With 6,000 individual medallion loans, that amounts to $2.7 Billion loan restructuring.

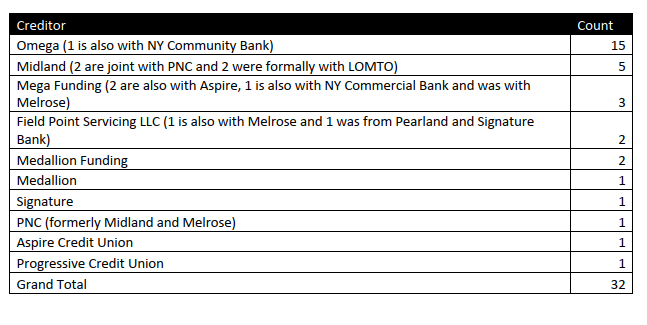

Loans Are Already Being Sold at Marked Down Amounts

Banks have been selling loans to each other at what we believe to be marked down rates, but owner-driver borrowers are not afforded the same mark down in the form of debt forgiveness, nor are loans modified at the mark down rate. A member of ours purchased the medallion for $400,000 in 2006 with financing from Progressive Credit Union. The loan was sold to Capital One and from there to Field Point. In 2018, Field Point offered to sell him the medallion for $300,000. He hired an attorney and the attorney told him that Field Point had purchased the loan for $170,000 from Capital One. Our member counter offered to pay $225,000 but Field Point wanted no less than $300,000. To this day, that remains their offer.

The NCUA acknowledged they have been helping restructure loans through "payment reductions, lower interest rates and term adjustments." If the agency has extended flexibility and support to the lenders, again, the benefits have not trickled down to the actual owner-driver.

Monthly Mortgage must be set at $900

It is not enough to have debt be forgiven. We have found there to be no correlation between the debt amount and the monthly mortgage. That is, an owner-driver with less than $100,000 may pay more each month than an owner-driver with $700,000 debt.

Setting the monthly mortgage at $900 will allow owner-drivers to wipe out the current average annual debt of $26,000.

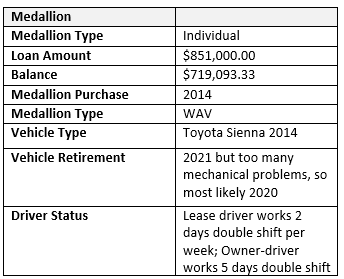

NYTWA Member Profile

Below is a profile of one of our members. He, his wife and their three children – aged 20, 12 and eight - live in a one family home in Queens. After modest cost of living, and despite having additional income from a tenant, medallion lease, and income from the spouse’s job, the family still ends the year with a negative $34,000. At the reduced monthly mortgage, they would reduce the annual debt to $6,000. With additional gain of fares, the family could break even.

Setting the monthly mortgage at $900

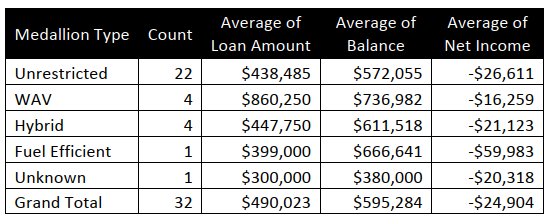

will allow owner-drivers to wipe out average annual debt. In this example, the driver’s current annual household debt is $24,904 while the current average annual debt is $26,000.

A profile of one of our members…

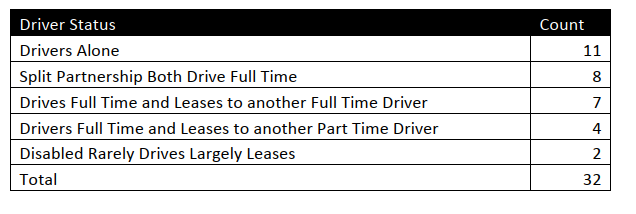

Who drives a Wheelchair Accessible Vehicle and has a part-time second driver.

Costs for the typical medallion operating expenses paid by owner-drivers…

are over $5,500 a month, while the reduced mortgage would allow expenses to come down by over $2,200. With the reduced monthly mortgage and additional gain of fares, the family could break even.

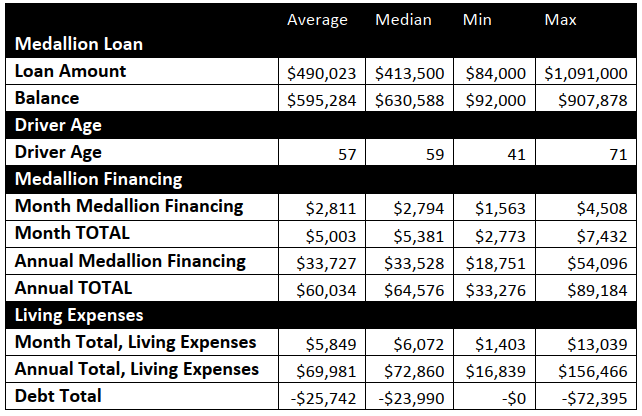

Findings from Hardship Intakes

Survey is based on 32 Hardship Intakes conducted with NYTWA members who are owner-drivers. The averages presented do include medallions that are 50/50 partnerships. As a result the averages are slightly lower than individuals facing the full costs of a medallion themselves. To account for this the median is also presented.

A survey of 32 detailed Hardship Intakes by NYTWA found: average outstanding loan balance is $595,284. The average age of owner-drivers is 57. The average monthly medallion payment is $2,811 and monthly operating expenses average $5,003. The average family cost of living expenses are $5,849 per month. The average end of year balance for families is a negative $25, 742. Capping mortgages at $900/mo. would wipe out this deficit and keep families whole.

NYTWA analysis of online medallion transaction records filed with Taxi and Limousine Commission found: There were more medallion foreclosures in January 2019 than in the entire years of 2015, 2016 and 2017. There were total of 139 foreclosures, bankruptcies or other transfers in 2017 and 836 in 2018.

The Daily News and Streetsblog reported recently that fare revenue per taxi is by 36% less today, since 2011. With a cut in the value of a dollar by 12.5 percent due to inflation, the real drop in revenue is 44 percent. As expenses go up, actual driver take home income has fallen by even more. Since February 2019, NYS has been collecting a $2.50 Congestion Surcharge on all trips that drop off, pick up or drive through 96th Street and below in Manhattan, despite a report that the surcharge is expected to decline revenue by another 30% per taxi by the end of 2019.

Annual Driving Income & Expenses 2018

Retirement Fund and Other Benefits

One of, if not the, primary reasons that lease drivers pulled money together through savings and personal loans to invest into a medallion has always been to have a retirement. If the market value goes up, a retired owner-driver could cash in by selling or could make money from leasing to a broker who in turn would finance the vehicle and lease the medallion to a driver, or lease both the medallion and vehicle. Many owner-drivers forego life insurance plans and instead rely solely on the medallion as a safety net for their surviving family. That safety net is no more.

The spouse of one of our members who passed away now finds herself in debt of $13,000 per year as she doesn’t earn enough leasing revenue to cover the mortgage, but depends on the revenue as cash flow support. They never bought a house or invested in another business. The medallion went underwater before they thought to sell it. She lives in a modest one-bedroom apartment, with barely any leisure and no luxury.

Lack of retirement savings and pensions is a growing problem across the country. 29% of households aged 55 and older have neither. An American worker who accrued social security through employer contribution is expected to average $17,500 per year in social security. Meanwhile, cost of living is on average $38,600 for US cities. That leaves a shortfall of $21,100.

A Retirement Fund for yellow cab drivers with immediate cash out of $15,000 for those over 62 who have not yet been able to retire, assuming such a population is no more than 20%, could cost $60 Million.

The entity which purchases underwater loans could calculate such expense while restructuring loans with borrowers. At just $5,500 per year, a pension could be established for drivers and their families.

Further, an industry-wide health and other benefits fund for up to 95,000 full-time yellow cab, green cab, livery, black car, and App drivers could be established through as little as 32 cents per fare by converting the city’s Health and Hospital Corporation’s sliding scale, pay as you use Options Program, into a low-cost premium program.

Combining the cost of a pension fund with the Health and Other Benefits utilizing HHC Options Program would bring the total cost to $1.75 per fare. Over 48 weeks of the year, the cost for healthcare, other benefits, and retirement per driver would be between $140 to $233 per week, or $23 to $39 per shift over six shifts. Returning this revenue to yellow cab drivers would allow for a healthy life with the dignity of retirement.

Campaign Media

NYTWA Members at a press conference with Council Members Mark Levine and Carlina Rivera on July 11, 2019 to tell the city, “Debt Forgiveness Now!”

Watch NYTWA Testimony at the June 24th City Council Hearing on the Owner-Driver Crisis!

NYTWA Executive Director Bhairavi Desai’s Testimony

Individual medallion owner-driver and NYTWA member Mouhamadou Aliyu’s Testimony

Individual medallion owner-driver and NYTWA member Golam Istiaque’s Testimony

Standing room only at the Emergency Meeting after the New York Times two-part investigation was published on May 19.